Mont Tucker and Sarah Nielsen have big dreams of becoming homeowners and building a stable future for their daughter. With the support of Shay Port, a friend turned financial coach, they are beginning to realize their dreams.

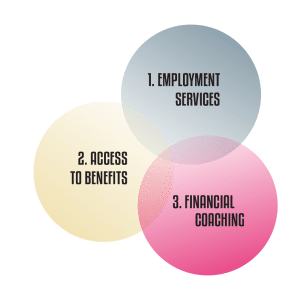

Financial Opportunity Centers [FOCs] bundle three core services together – employment services, access to benefits and financial coaching – to improve the financial bottom line for low-to moderate-income individuals.

Oakland Planning and Development Corporation (OPDC)’s JobLinks Program is one of three FOCs in the Pittsburgh area supported by Neighborhood Allies. By providing financial coaching, training and traditional career services all under one roof, OPDC helps people do more than get a job — they build stability over time by creating a long-term plan for financial success. The staff team sticks with clients for as long as they need to achieve their goals and helps residents make real, lasting changes to their financial futures. JobLinks sees over 300 clients a year and deploys a staff of five to help local residents take back control of their financial futures. In 2017 alone, JobLinks helped 145 secure employment, 48 increase their net income, 24 improve their credit score and 50 improve their net worth!

Mont and Sarah are two clients at JobLinks who have accessed the bundled support and services available to FOC clients to get their financials back on track.

Mont met Shay, a Financial Coach at OPDC’s JobLinks, while working as a manager at Dobra Tea in Squirrel Hill. He needed help filing his taxes and heard that Shay was a C.P.A. and financial coach. After listening and learning about Mont’s financial situation as well as his goals and dreams, Shay immediately knew that she could help him with more than his taxes. “As soon as we spoke, I knew it was just a matter of giving Mont the financial guidance he had never received. He was already highly motivated.”

While Mont had a stable job and was making money, he had no established credit, hadn’t been budgeting or saving much for the future and saw no way of ever having the cash or the ability to get the mortgage he needed to realize his dream of becoming a homeowner. “Shay taught me to begin thinking about money as an investment in myself. It completely changed the way I looked at putting away money that I would have otherwise spent.”

Sarah, Mont’s partner, had two years worth of unopened mail that she was avoiding because of bills and debt from student loans that had built up. “I just accepted that things like being a homeowner, or even not being hassled by collectors, were not in the cards for me. I thought I was in a hole and couldn’t get out.”

That conversation led to more discussions on programs and benefits offered at the FOC that both Mont and his partner Sarah might be eligible for. Shay introduced Mont and Sarah to other programs and benefits like First Commonwealth Bank’s “First Front Door” Program, the credit building program, Twin Accounts, and the Tax Refund Savings Challenge, all of which they ultimately ended up taking advantage of.

FHLB Pittsburgh’s First Front Door Program | First Front Door (FFD), helps qualified first-time homebuyers with closing costs and down payment. For every $1 you contribute, you can receive $3 in grant assistance, up to a maximum of $5,000.

Twin Accounts™ | Encourage saving by providing an incentive families to make timely payments into a savings account. Every time a monthly payment of $25 is reported to the credit agencies, it is matched by Neighborhood Allies, providing a powerful incentive to save $300 in one year which, with the match, accumulates to $600 at the end of the year, positioning participants to build emergency savings or to invest.

Tax Savings Challenge | For National Financial Goal Day, Neighborhood Allies issued a Savings Challenge to encourage folks to save a portion of their tax refund. Any individual working with a financial coach who deposited $1,000 from their 2016 tax refund into a bank or credit union and saved it for one year would receive $500.

“I just accepted that things like being a homeowner, or even not being hassled by collectors, were not in the cards for me. I thought I was in a hole and couldn’t get out.”

In addition to helping them access those benefits, Shay provided one-on-one coaching to Mont to help him open up an account at a credit union and to establish and increase his credit score. “Shay taught me simple things about credit, credit scores and finances that I never learned growing up.” Shay also helped Mont set up a retirement account online and showed him how to automate his monthly contributions to take advantage of dollar cost averaging.

In addition to helping them access those benefits, Shay provided one-on-one coaching to Mont to help him open up an account at a credit union and to establish and increase his credit score. “Shay taught me simple things about credit, credit scores and finances that I never learned growing up.” Shay also helped Mont set up a retirement account online and showed him how to automate his monthly contributions to take advantage of dollar cost averaging.

Sarah also received one-on-one coaching from Shay. They worked on updating Sarah’s resume and discussed job opportunities. They also developed a budget that had a savings component built in, to ensure some money went into savings every month. Sarah ultimately ended up taking a new position at Trader Joe’s, where she is very happy and has even begun saving for retirement with the company’s 401(k). With Shay’s help, she was able to consolidate all of her public loans and get enrolled in an income-based repayment plan for her student loans.

Getting connected to JobLink’s FOC set Mont and his partner Sarah on the path to financial stability — connecting them with the services, programs and resources that made it possible to get their finances under control and establish a plan for creating a better economic future their family.