Our allies at WorkPittsburgh successfully raised $10,000, powered by 122 lenders through Kiva Pittsburgh to support the continued growth of their second chance employment initiative.

By: Jonny Price, Kiva U.S. | November 23, 2016 | www.lisc.org | Read the full article

Small Is Beautiful

I live in the heart of Silicon Valley, in the era of technological revolution. I look around me and see affluence unparalleled in the history of the world. The U.S. economy continues to grow, and the stock market is the highest it’s ever been.

But it may come as a surprise to many Americans that entrepreneurial activity has been declining for decades now. Since the Great Recession of 2008, more firms have been closing down than opening up—a marked contrast to the previous 40 years when start-ups outpaced closures.

And that trend is inextricably linked to the yawning income gap—in the past three decades, net wealth for the top 10 percent of American households increased by 87% while the net wealth of median households increased by only two percent. The bottom 10 percent of households saw a decline in net wealth from from $702 to minus $2,050 per year.

At Kiva, as at LISC, we believe that a crucial pillar of the solution is stoking a vibrant small business sector.

Small business owners, on average, are two and a half times wealthier than people who don’t own businesses. According to Andrew Yang, CEO of Venture for America, two thirds of new net jobs in the U.S. are being created by new firms fewer than five years old. “If you want to ease income inequality,” said Yang, “you want more new firms starting up and seeking employees.”

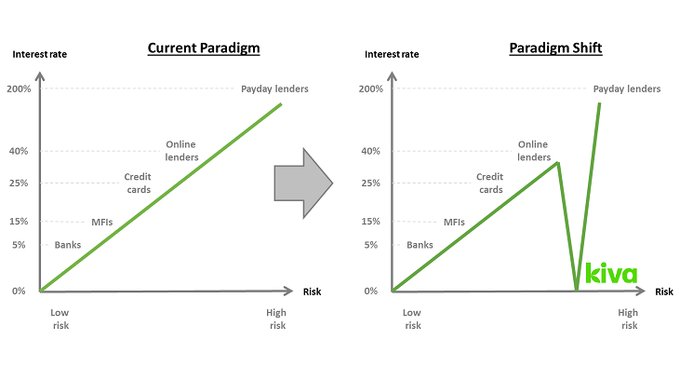

To make that happen, we need to tackle the challenges small and early-stage businesses face in accessing capital. Three years ago, when Bill Clinton launched Kiva in Little Rock, Arkansas, he noted that “the only people that can get real money are the people that don’t need to borrow it.” It’s true: low-income people and microbusinesses pay much more (in fees, interest rates, etc.) to access capital than do wealthy borrowers and large corporations—when they can access it at all.

At Kiva, we don’t just aspire to level this playing field. We’re trying to invert it.

Through technology, crowdfunding, and social underwriting innovations, we aim to make it a little easier for the little guys.

Together with community partners like LISC, the Barra Foundation and Google, and our 1.6 million individual lenders, we are working to expand access to zero percent interest loans for the 28 million microbusinesses that make up the economic backbone of this country. That way, we hope to help reinvigorate the small business sector and create wealth in communities that are increasingly at risk of being left behind.

That’s what we were able to do with Daniel Bull, who founded WorkPittsburgh, a company that trains people with a criminal background for living-wage jobs in the construction trades—people who typically struggle to get training and find decent work. Having served a 21-month prison term himself, Bull knows those challenges well. This year, a $10,000 zero interest Kiva loan, with a dollar for dollar match from LISC Small Business, is making it possible for Bull to expand WorkPittsburgh and help more formerly incarcerated people join the city’s economy.

Today, borrowers are usually reduced to numbers on a spreadsheet. Financial relationships are transactional and anonymous. When I save money in my bank account, that money is being lent to help someone else buy a house or open up a small business. There is a connection happening there. But I never see it.

Through Kiva, people can see those connections. If you make a $25 loan on Kiva, you learn the name of the entrepreneur whose business you are helping to get off the ground. You can learn about their history, their aspirations.

Take the story of Jasmine Ford, a 23-year-old baker extraordinaire, who cooked for word-of-mouth clients out of her home in Cincinnati, but dreamed of opening her neighborhood’s “go-to bakery.” Ford was able to prove her creditworthiness to Kiva by having people within her own community–friends, family, and customers–vouch for her business and character with loans of $25 or more. Ford’s loan then became visible on the Kiva website; more than 100 people supported Ford’s loan, a few lenders in Europe.

Today, Ford’s bakery, Jazzie Sweeties, has a new storefront and is doing a bustling business. Ford used the $10,000 loan from Kiva, together with a LISC Small Business match, to buy a commercial oven and refrigerated display case for the new space.

Every day on Kiva, personal—and unconventional—connections get made. Men lend to women, Muslims lend to manufacturing companies in the Rust Belt, immigrants lend to veterans, elderly lenders empower entrepreneurs in their teens.

If, in some small way, America’s finance system can be a mechanism for reinforcing the inter-connections between people that fuel it, then perhaps that system can help bring people together rather than drive them apart. Maybe our economic transactions can shine a light on the fact that we are all human beings, people who want the best for our children and our world.

LISC is proud to partner with Kiva in empowering entrepreneurs throughout America. Over the last year, LISC has supported 62 fully-funded small business owners across the country.

ABOUT THE AUTHOR

Jonny Price, Senior Director of Kiva U.S.

Jonny leads Kiva’s work to reach financially excluded and socially impactful entrepreneurs in the United States with 0% interest loans. He first arrived at Kiva in 2009 as a volunteer on a 5-month externship from his management consulting firm Oliver Wyman. After 6 years with Oliver Wyman in London and San Francisco, he joined Kiva full-time in 2011 to lead the direct loan pilot project Kiva Zip.